What is the PRGF?

The Portable Retirement Gratuity Fund (PRGF) is a fund established under the Workers’ Rights Act 2019. Where an employee is eligible to join the PRGF, the employer is required to make certain contributions to the PRGF in respect of that employee from 1 January 2020. When the employee retires at/after the age of 60 (or in case of earlier retirement in circumstances provided in the law), the administrator of the PRGF pays a retirement gratuity to that employee. The employer is not required to pay any retirement gratuity to the employee.

When does the PRGF come into operation?

The PRGF provisions initially came into operation on 1 January 2020. Thereafter, following changes brought through the COVID-19 (Miscellaneous Provisions) Act 2020, certain payment obligations have been suspended until January 2022 as explained below.

In respect of what employees should employers contribute to the PRGF?

All employees except:

– public officers, local government officers and those who derive retirement benefits under the Statutory Bodies Pension Funds Act

– those whose retirement benefits are payable in accordance with a private pension scheme licensed by the Financial Services Commission

– non-citizens

– those earning more than MUR 200,000 in monthly basic salary

Employees who are not eligible to join the PRGF remain entitled to a retirement gratuity paid by their employer, subject to having been in the continuous employment of that employer for at least 12 months (as under the previous legislation). The gratuity is computed based on 15 days’ remuneration per year of employment with that employer, subject to certain deductions which can be made in case the employer contributed to a private pension scheme for the benefit of that employee or granted other gratuity or retirement benefit to the employee.

Monthly contributions

Monthly contributions based on an employee’s monthly remuneration (i.e. basic wages + productivity bonus + attendance bonus + overtime). They are paid to the MRA.

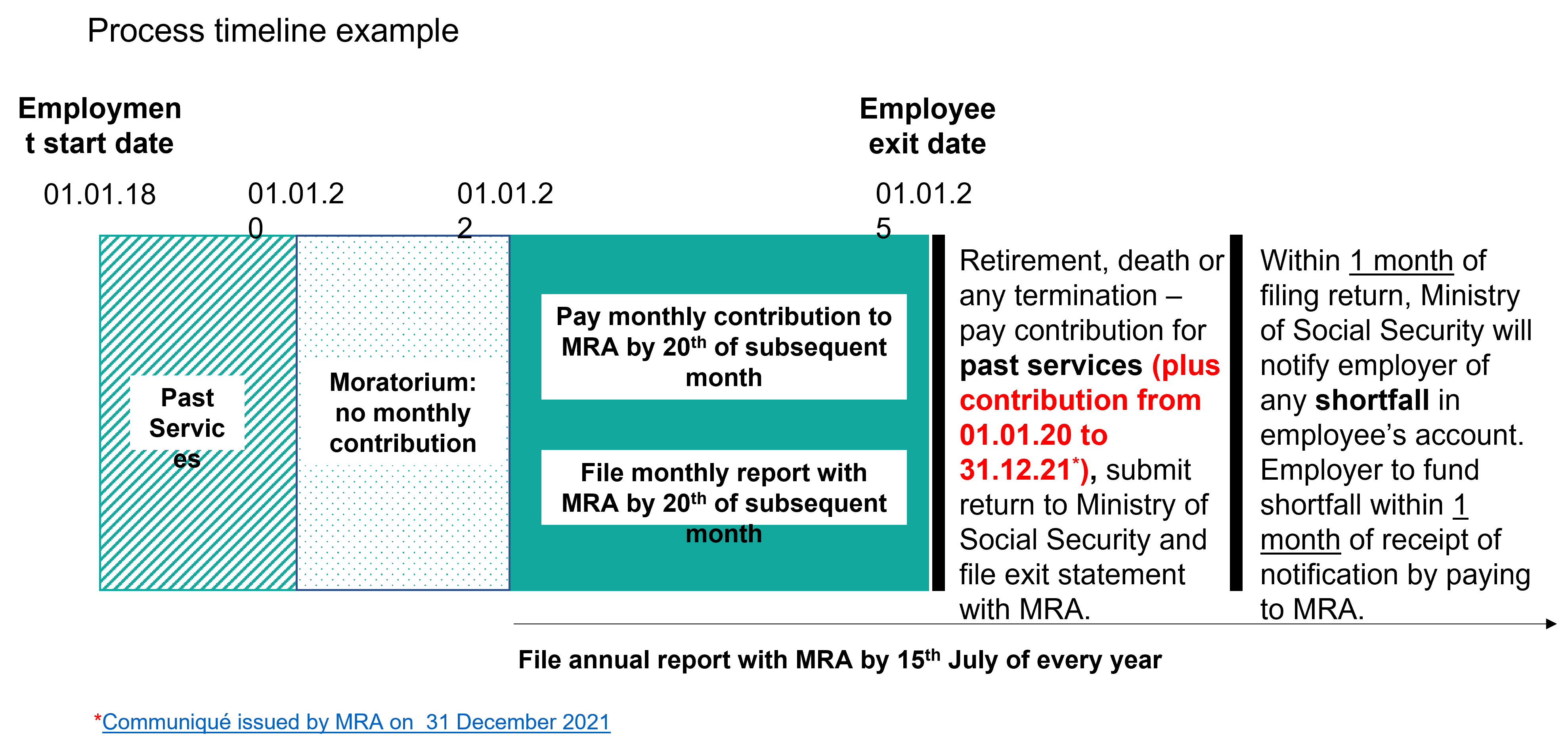

Monthly contributions for the period starting 01 January 2020 and ending 31 December 2021 were suspended.

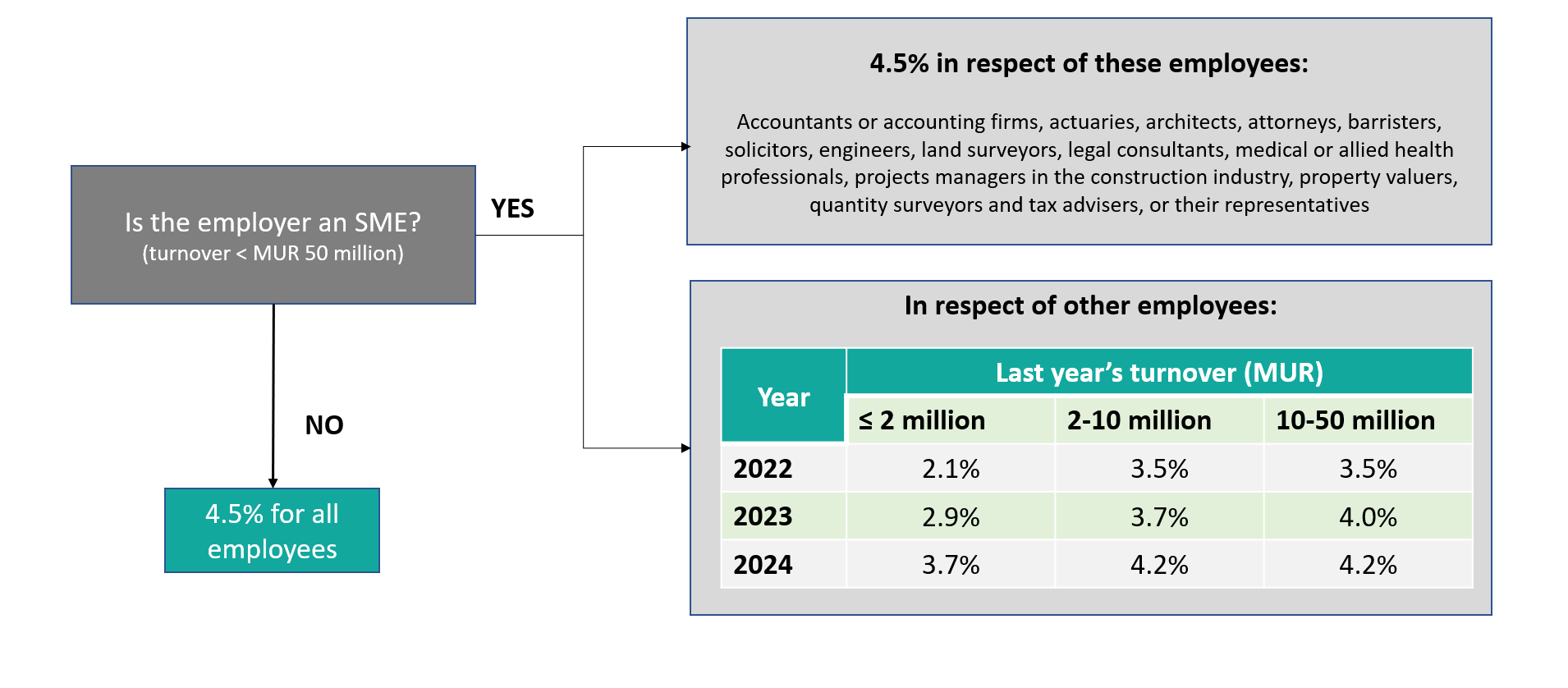

The applicable rate of contribution varies from 2.1% to 4.5% depending on an employer’s annual turnover and categories of employees (see summary table below). Where the employer’s rate of contribution is less than 4.5%, the government funds the difference between that rate and 4.5%.

Contributions for past services

Where an employer started to contribute to the PRGF in or after January 2020 in respect of an employee and continues to do so, the employer may pay to the MRA at any time before the employee’s termination/retirement/death, the contributions relating to the period during which that employee worked for that employer before 1 January 2020.

Alternatively, if the employer does not pay the contribution for past services before an employee’s termination/retirement/death, the employer will be required to make that payment to the MRA (in case of termination), to the employee (in case of retirement) or to the employee’s heirs (in case of death) within 1 month after the date of the termination/retirement/death. The employer will also have to pay any monthly contributions that it had not paid to the MRA for the period 01 January 2020 to 31 December 2021.

The contributions are computed on the basis of 4.5% of the employee’s last monthly remuneration.

Adjust for shortfall/surplus

After an employee’s exit, the employer may be required to fund any shortfall that may exist between the amount standing in the employee’s individual account within the PRGF and 15 days’ final remuneration per year of employment with that employer.

If there is a surplus in the employee’s account within the PRGF, it can be used to make up for unpaid contribution or credited to the employer’s account to pay contributions for past services of other employees.

Reporting obligations

– Submit monthly report to MRA by the 20th of every month setting out the remuneration paid to employees and the amount of contribution made on behalf of the employees

– Submit annual return to MRA by 15 July of every year with an updated list of names and date of birth of employees in an employer’s employment as at 30 June of that year

– Within 1 month of termination or death of employee, submit to the Ministry of Social Security a return setting out certain prescribed details

– Notify MRA within 1 month of an employee’s cessation or termination, change of employment, retirement or death

Summary – process timeline

What happens if an employee exits before 1 January 2022?

Where an employee retires or dies between 1 January 2020 and 31 December 2021 and the employer did not pay contributions to the PRGF in respect of that employee, the employer is required to pay to the employee or his legal heirs a gratuity computed on the basis of 15 days’ final remuneration per year of employment.

Where an employee’s employment is terminated between 1 January 2020 and 31 December 2021 and the employer did not pay contributions to the PRGF in respect of that employee, the employer is required to pay to the MRA a total contribution equivalent to 15 days’ final remuneration per year of employment from the date the employee started employment with that employer.

Where an employee resigns between 1 January 2020 and 31 December 2021 and the employer did not pay contributions to the PRGF in respect of that employee, the employer is required to pay to the MRA a total contribution equivalent to 15 days’ final remuneration per year of employment starting on 1 January 2020.

If the employer started but ceased to pay contributions to the PRGF in respect of an employee before his exit, the employer should pay the required gratuity or contributions upon the employee’s exit as set out above, but deduct the contributions already paid to the MRA from such amount to be paid on the employee’s exit.

This note does not cover every aspect of the topic with which it deals. It does not represent legal or other advice. For specific advice relating to the PRGF and/or private pension schemes, please get in touch with a member of our team.

Partner