The Social Contribution and Social Benefits Act was enacted on 30 July 2021. In a nutshell, it repealed the Contribution Sociale Généralisée Regulations 2020 (the “CSG Regulations”) and amended the National Pensions Act as explained below. This note summarises the changes brought by the Act. It does not, however, deal with all aspects of the Act. It does not represent legal or other advice.

(a) Recap: changes brought in 2020

Certain amendments to the legislative framework concerning social contributions and benefits were made in 2020. By virtue of the Finance (Miscellaneous Provisions) Act 2020 that amended the National Pensions Act, contributions to the National Pension Fund (NPF) ceased from 1 September 2020 and were replaced by the Contribution Sociale Généralisée (CSG). Whereas the NPF contributions were paid into a specific fund, out of which the social benefits were then payable, the CSG payments are credited to the Government’s Consolidated Fund.

The CSG Regulations were then issued in September 2020, providing that:

- where an employee (subject to certain exempted categories) earns up to MUR 50,000 in basic monthly salary, the employee and the employer are respectively required to contribute 1.5% and 3% of the employee’s basic salary;

- where an employee (subject to certain exempted categories) earns over MUR 50,000 in basic monthly salary, the employee and the employer are respectively required to contribute 3% and 6% of the employee’s basic salary;

- where a domestic worker earns up to MUR 3,000 in basic monthly salary, the only required contribution to be made is by the employer and amounts to 3% of the employee’s basic salary; and

- a self-employed person, irrespective of his level of income, is required to contribute MUR 150 per month.

The validity of the CSG Regulations is currently being challenged before the Supreme Court of Mauritius. The new Act seems to address some of the criticism made in respect of the CSG rates that were fixed by regulations. The Act deletes from the National Pensions Act, all provisions relating to the CSG (including the Minister’s powers to make the CSG Regulations), repeals the CSG Regulations and replaces them with provisions in the Act.

(b) The new contributions

The Act, in effect, relabels the CSG as a “social contribution” and raises the level of the contribution in two respects:

- whereas under the CSG Regulations, the contribution was computed as a percentage of the employee’s basic salary only, the Act requires employees and employers to also pay a social contribution on the basis of their statutory end of year bonus; and

- whereas under the CSG Regulations, a self-employed person was required to pay a flat contribution of MUR 150, their contribution will henceforth vary according to their level of income.

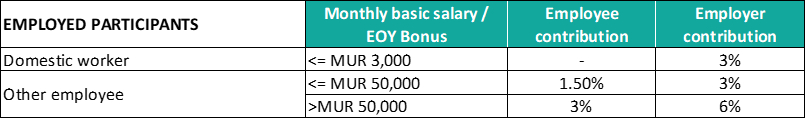

The social contributions required under the Act are summarised in the following tables.

The “participants” include inter alia public sector employees, non-citizens (except certain limitative categories), persons aged 65 and above, etc. A more comprehensive definition is provided in the Act, but not set out in full in this briefing note.

In respect of public sector employees, the Act requires the employer to pay the employee’s contribution in their stead – as it currently is under the CSG Regulations – until such time as it is otherwise provided by way of regulations.

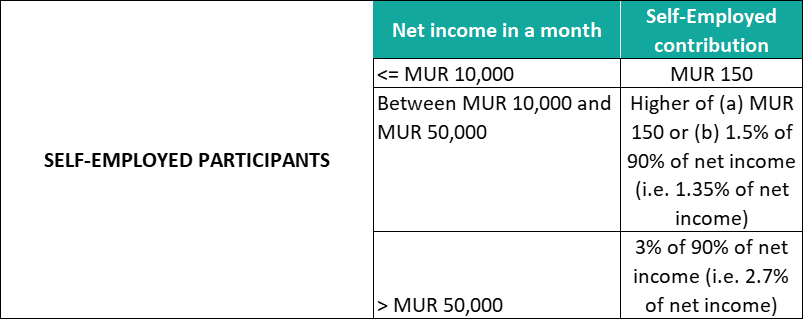

The contributions of self-employed participants are summarised in the following table.

A self-employed person’s contribution is computed by reference to their “net income”, which has the same meaning as in the Income Tax Act, except that it does not include passive income. The self-employed person may opt to compute their net income in respect of a month either as (a) 1/12th of the net income of the financial year immediately preceding that month, provided that they have worked during the corresponding 12 months, or (b) the net income for that month. The person cannot thereafter change the basis of computation of the net income for that month.

The Act requires the above contributions to be made from 1 September 2021. The contributions are payable to the MRA to be credited to the Consolidated Fund.

For the avoidance of doubt, the proposed social contribution under the Act does not replace contributions that employers are required to make to the Portable Retirement Gratuity Fund (PRGF). The PRGF provisions under the Workers’ Rights Act continue to apply.

(c) The benefits under the Act

The National Pensions Act provides inter alia for “basic pensions” that are available to certain categories of persons, such as the basic retirement pension of MUR 9,000 or the widow’s basic pension of the same amount. The Act does not make any changes to these basic pensions. The relevant provisions of the National Pensions Act remain unchanged.

Contributory retirement pension

The National Pensions Act also provides for “contributory pensions”, that is, pensions that are available to certain categories of persons in respect of whom contributions are required to be made under the National Pensions Act. The contributory retirement pension is one of them. It is currently computed by reference to a points-based system. The new Act provides for a new contributory pension from 1 September 2023, namely the “retirement benefit”, which amounts to a maximum of MUR 4,500 per month. The Act also provides for the payment of an end of year bonus equivalent to the amount of the retirement benefit. However, our reading of the Act is that it does not explain the method of computation of this monthly retirement benefit. Nor does it explain whether that the retirement benefit will eventually replace the contributory retirement pension under the National Pensions Act.

The conditions of eligibility to the retirement benefit under the Act are summarised as follows.

- A residing citizen is entitled to the retirement benefit if (i) they have reached the retirement age and (ii) they have resided in Mauritius for at least 20 years in aggregate since their 18th birthday.

- They remain entitled to the retirement benefit even if they are absent from Mauritius for some time, provided that their absence does not exceed a continuous period of 6 months in any period of 12 consecutive months.

- If the citizen is absent from Mauritius for a continuous period of more than 6 months in a given period of 12 consecutive months, the citizen is nevertheless entitled to the retirement benefit if they have paid the social contribution for at least 50% of the years between 1 September 2020 and the date of making the application for the benefit – however, they will need to elect to either (i) defer the retirement benefit until they return to reside in Mauritius or (ii) accept a discounted lump sum in lieu of the retirement benefit.

- A non-citizen is entitled to the retirement benefit if (i) they have reached the retirement age, (ii) they have resided in Mauritius for at least 20 years in aggregate, and (iii) they have paid the social contribution for at least 50% of the years between 1 September 2020 and the date of making the application for the benefit.

- In the case where the non-citizen leaves Mauritius for a continuous period of more than 6 months in a given period of 12 consecutive months, the non-citizen will need to elect to either (i) defer the retirement benefit until they return to reside in Mauritius or (ii) be paid a discounted lump sum in lieu of the monthly retirement benefit.

- Early retirement – In certain sectors (construction, public transport, salt-manufacturing, sugar industry and tea industry), the retirement benefit is available to a person who has the option to retire before the age of 65. The person becomes entitled to the retirement benefit on reaching the age of 60 or above, provided that they (i) have resided in Mauritius for at least 20 years in aggregate since their 18th birthday, (ii) are not in employment whilst deriving the retirement benefit, and (iii) have been employed in that sector for at least 10 consecutive years at the time of retirement.

Industrial injury benefits

The National Pensions Act currently provides for allowances and pensions (including compensation by the employer) to be paid to employed persons or their surviving spouse and dependents in cases of industrial injuries. An industrial injury means an (i) industrial accident arising out of and during the course of employment or (ii) a given disease caused by the nature of the employment. The Act transposes these provisions from the National Pensions Act (with certain amendments) into the new legislation, with retrospective effect from 1 September 2020. In particular, whereas certain industrial injury benefits are currently computed under the National Pensions Act by reference to a person’s annual earnings, the new Act caps these annual earnings to MUR 600,000 for the purposes of computing those benefits.

In addition, the Act extends the industrial injury benefits to self-employed persons from 1 September 2021.

(d) The establishment of the Social Benefits Review Committee

The Act further sets up a Social Benefits Review Committee of 16 members, including 4 representatives of employers’ organisations and 4 members of any workers’ organisation representing workers employed in the private sector. The purpose of that committee is to make recommendations to the Minister of Finance for the purpose of enhancing the social benefits and maintaining their sustainability.

Partner

For assistance on employment law matters, contact Mannish Ajodah or Bilshan Nursimulu.